Earn More, Stress Less — With MoneyForMore.

Buying a home in Kansas is a big step, and knowing how much your monthly payments will be can help you plan better. A mortgage calculator Kansas is a simple tool that lets you figure out your monthly mortgage costs quickly. Whether you’re a first-time buyer or just curious, using a mortgage calculator Kansas helps you see how different prices, interest rates, and down payments affect your budget. This makes buying a home less confusing and helps you make smarter choices for your future.

What Is a Mortgage Calculator Kansas and How Does It Work?

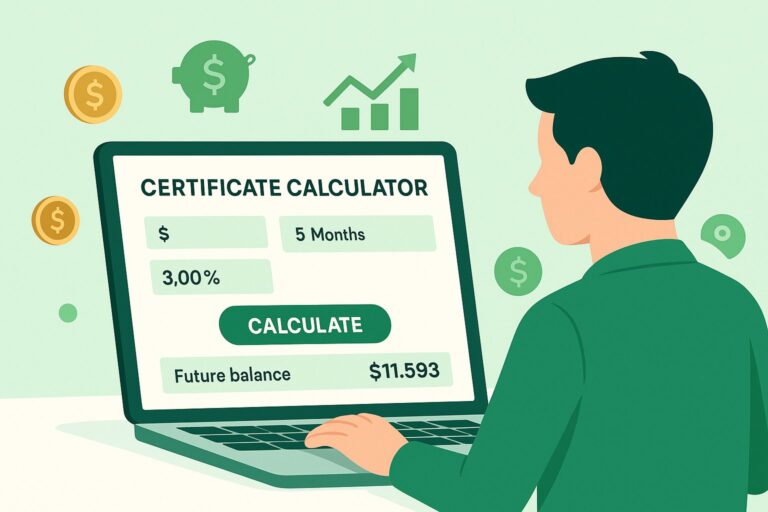

A mortgage calculator Kansas is a simple tool that helps you find out how much your home loan payments might be every month. It works by using numbers you give it, like the price of the house, the interest rate, and how many years you want to pay back the loan. Then, it shows you your estimated monthly payment.

This tool is easy to use and doesn’t require any special skills. Just type in the numbers, and it does the math for you. It helps you understand how your loan works and how much money you need to set aside every month for your house.

Using a mortgage calculator Kansas gives you a clear picture of your finances. It helps you plan better before you decide to buy a home. Knowing your payments early saves you from surprises later.

Visual Breakdown of Monthly Payments

To help you better understand where your monthly money goes, here’s a simple chart. It shows how much you pay for interest and how much for principal.

Why Using a Mortgage Calculator Kansas Helps Kansas Homebuyers

Buying a house is a big decision, and a mortgage calculator Kansas makes this process easier. It helps homebuyers in Kansas see how different factors like the house price or interest rates change their monthly payments. This way, they can choose the best loan for their budget.

This tool also helps compare different loan options. For example, you can check how a 15-year loan compares to a 30-year loan in monthly cost. This information helps you pick what suits your family best.

With a mortgage calculator Kansas, you get confidence when talking to lenders. You can ask better questions and understand the answers because you already know the basics of your loan payments.

How to Enter Your Details in a Mortgage Calculator Kansas

When you open a mortgage calculator Kansas, you will see empty boxes to fill. First, enter the price of the home you want to buy. This is the amount the house costs before you pay anything.

Next, type in the percentage you plan to pay as a down payment. This is money you pay upfront to lower your loan. Then, write the interest rate your bank or lender offers. This number shows how much extra money you will pay on top of the loan.

Finally, enter how many years you want to take to pay back the loan. Usually, people choose between 15 and 30 years. After entering all this, the calculator will show your estimated monthly payment. It’s quick and easy!

Understanding Monthly Payments with a Mortgage Calculator Kansas

Your monthly payment is the amount of money you will pay every month for your home loan. A mortgage calculator Kansas shows you this number based on your home price, interest rate, and loan length. It helps you know if the payment fits your budget.

The payment includes two parts: the principal and the interest. The principal is the money you borrowed, and the interest is the cost to borrow it. Over time, the amount going to the principal grows, and the interest part goes down.

Seeing this monthly payment helps you decide if you can afford the home. It also helps you save money by choosing better loan terms or paying a bigger down payment.

💡 Sample Monthly Payments Table (Based on Common Kansas Mortgages)

Here’s a helpful table that shows how much you might pay each month with different loan sizes in Kansas. These are just examples to help you understand.

| Loan Amount | Interest Rate | Loan Term | Estimated Monthly Payment |

|---|---|---|---|

| $150,000 | 6.5% | 30 Years | $948 |

| $200,000 | 6.5% | 30 Years | $1,264 |

| $250,000 | 6.5% | 30 Years | $1,580 |

| $300,000 | 6.5% | 30 Years | $1,896 |

How Mortgage Calculator Kansas Shows Interest and Principal Breakdown

When you use a mortgage calculator Kansas, it doesn’t just tell you the total monthly payment. It also shows how much of that payment goes to interest and how much goes to paying back the loan’s principal amount.

At the start of the loan, most of your payment pays interest. As time passes, more of your payment goes toward reducing the principal balance. This breakdown helps you understand your loan better.

Knowing this can help you decide if making extra payments is a good idea. Extra payments go directly to the principal, which can save you money on interest and shorten your loan time.

How Down Payment Affects Your Results in a Mortgage Calculator Kansas

Your down payment is the money you pay upfront when buying a home. Using a mortgage calculator Kansas shows you how this amount changes your monthly payments. The more you pay as a down payment, the less you need to borrow.

A bigger down payment means smaller monthly payments. It also reduces the total interest you will pay over the loan’s life. This helps you save money and pay off your home faster.

If you pay a smaller down payment, your monthly payments will be higher. Sometimes, you may also need to pay extra insurance. Knowing this with a mortgage calculator Kansas helps you plan your finances well.

Using a Mortgage Calculator Kansas to Compare Loan Terms Easily

Mortgage loans come with different lengths or terms, usually 15 or 30 years. A mortgage calculator Kansas lets you compare these options side by side. This helps you see how your monthly payments change with different loan lengths.

A 15-year loan usually has higher monthly payments but lower total interest. A 30-year loan has lower monthly payments but more interest paid over time. The calculator shows these differences clearly.

This makes it easier to pick a loan term that fits your monthly budget and long-term financial goals. You can even try other term lengths to find the best fit.

Must Read Home Addition Cost

Tips for Getting the Best Results from a Mortgage Calculator Kansas

To get the most accurate results from a mortgage calculator Kansas, use real numbers from your lender or bank. This includes the exact interest rate and fees you expect to pay. Using guesses can give you wrong results.

Also, include all costs if the calculator allows. This may be loan fees, taxes, or insurance. This helps you see the full monthly cost of owning a home.

Try different scenarios, like changing the down payment or loan length. This helps you understand how small changes affect your payments and total cost.

Try the Interactive Mortgage Calculator Kansas

Ready to calculate your monthly mortgage payment in Kansas?

Use the simple calculator below — just enter your info and get instant results.

Mortgage Calculator Kansas

Conclusion

Using a mortgage calculator Kansas is a smart way to plan your home loan. It helps you know how much money you will pay every month before you buy a house. This makes it easier to choose the best loan and avoid surprises later.

The calculator also shows you how different things like down payment, loan length, and interest rate change your payments. By using it, you can feel confident and ready to buy your dream home in Kansas!

FAQs

Q: What is a mortgage calculator Kansas?

A: It is a tool that helps you find out how much your home loan payments will be every month.

Q: How do I use a mortgage calculator Kansas?

A: You enter the home price, interest rate, down payment, and loan years. The calculator shows your monthly payment.

Q: Can the calculator show interest and principal?

A: Yes, it breaks down how much of your payment goes to interest and how much pays the loan balance.

Q: Does a bigger down payment help?

A: Yes, a bigger down payment means smaller monthly payments and less total interest.

Q: Can I compare loan lengths with the calculator?

A: Yes, you can check how 15-year and 30-year loans change your monthly payments.

Q: Are the calculator results exact?

A: No, they are estimates. Your real payments may change because of fees or changes in interest rates.

Q: Should I include extra costs like taxes in the calculator?

A: If the calculator lets you, yes. This helps you see the full monthly cost of owning a home.

Stay Tuned MoneyForMore