Earn More, Stress Less — With MoneyForMore.

Buying land is an exciting step toward building your dream home or starting a new project. But before you decide, it’s important to know how much loan you can afford and what your monthly payments might be. This is where a land loan calculator becomes very helpful. A land loan calculator helps you quickly find out your expected monthly EMI (Equated Monthly Installment), total interest, and total amount payable for your loan. Using a land loan calculator saves time and makes your loan planning easier and clearer.

How to Use a Land Loan Calculator to Estimate Your Loan EMI

When you want to buy land, knowing how much your monthly payment will be is very important. A land loan calculator helps you figure out this easily. You only need to enter the loan amount, interest rate, and loan tenure. The calculator will then show you the EMI or monthly payment. This helps you plan your budget well.

You don’t have to do hard math because the calculator does it for you. It saves time and reduces mistakes. Also, you can try different loan amounts or interest rates to see what suits you best. This way, you can decide on a loan that fits your money and needs.

Using the tool is simple. Just fill the numbers and press calculate. You will get the loan details quickly. It is the best way to check your affordability before applying for a loan.

Land Loan Calculator for Easy Planning

Land Loan Calculator

Benefits of a Land Loan Calculator for Homebuyers and Investors

Many people want to buy land, but they worry about the cost. A land loan calculator is very helpful for them. It gives a clear idea about how much money they will pay every month. This helps avoid surprises later.

Investors also use this tool to plan better. They can check different loan options and pick the best one. The calculator shows the total interest and payment, so they know the full cost. This helps them make smart decisions.

Another good thing is that it helps in comparing loans from different banks. Instead of asking each bank for details, the calculator gives quick answers. It saves time and makes the process easier.

Step-by-Step Guide on Filling Inputs in a Land Loan Calculator

First, enter the loan amount you want to borrow. This is how much money you need to buy the land. Next, type the interest rate, which the bank will charge yearly. Make sure to check the current rates before entering.

After this, enter the loan tenure. This means how many years you want to take the loan for. Usually, it can be between 5 to 20 years for land loans. Once all information is filled, press the calculate button.

The calculator will show you the monthly EMI, total interest, and total payment amount. This step-by-step method is easy and saves your time. Just be sure to enter correct numbers for accurate results.

What Factors Affect Your Results in a Land Loan Calculator?

Your loan results can change based on a few things. First is the interest rate. If the rate is high, your monthly payment will be more. So always check the current interest rates before using the calculator.

Another important factor is the loan tenure. If you choose a longer time, your EMI will be lower, but you will pay more interest overall. A shorter tenure means higher EMI but less interest.

The loan amount you enter also changes the results. Higher loan means higher monthly payment. So choose an amount you can pay easily. Knowing these factors helps you use the calculator wisely.

Land Loan Calculator: Understanding Interest Rates and Tenure

Interest rate means how much extra money the bank will charge you yearly on the loan amount. This rate can be fixed or floating. Fixed means the rate stays the same during the loan, and floating means it can change with the market.

Loan tenure is the number of years you take the loan for. Usually, land loans have shorter tenures than home loans. It can range from 5 to 15 years. Choosing the right tenure is important because it affects your EMI and total interest.

When you use the land loan calculator, you can test different interest rates and tenures. This helps you pick the best option for your budget.

Land Loan Calculator Amortization Table

`; } html += '

';

document.getElementById('amortTable').innerHTML = html; }

Common Mistakes to Avoid While Using a Land Loan Calculator

Many people make mistakes when using a land loan calculator. One common error is entering the wrong interest rate. Always use the exact rate offered by your bank or lender to get correct results.

Another mistake is not considering other fees like processing fees or taxes. These charges add to your loan cost but are not shown in the calculator. So remember to check these separately.

Sometimes, users forget to update the tenure or loan amount when comparing options. This can give wrong monthly payment ideas. Always double-check your inputs before calculating.

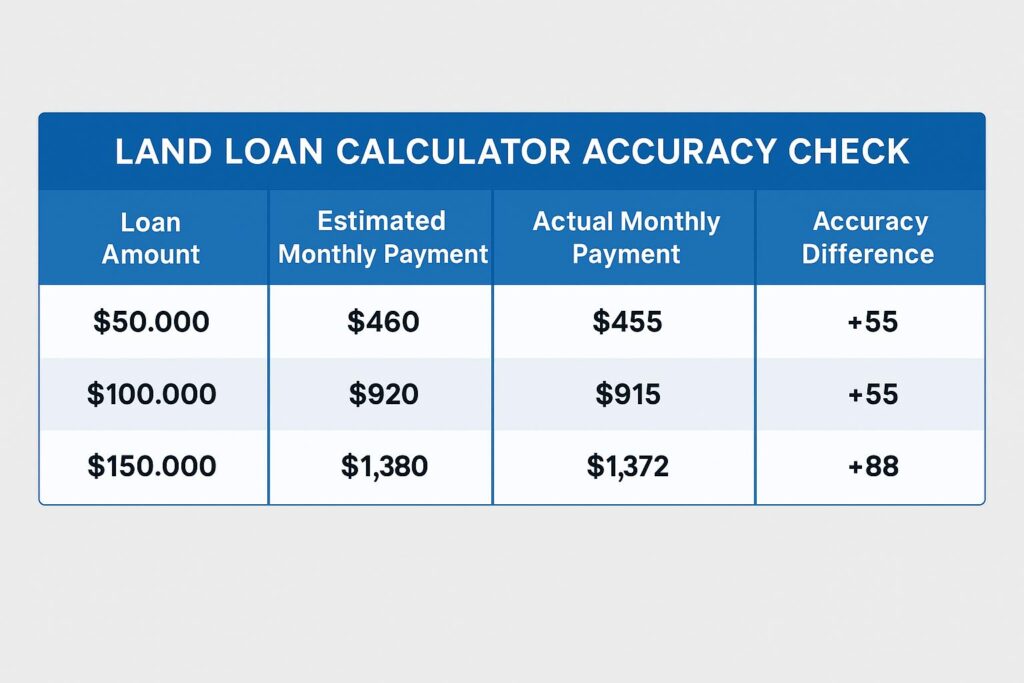

How Accurate Is a Land Loan Calculator for Planning Your Budget?

A land loan calculator gives a good estimate but is not 100% perfect. It shows the EMI based on the numbers you enter. However, actual interest rates and other charges may vary.

Banks may charge processing fees, legal fees, or taxes that the calculator doesn’t include. Also, if your loan has a floating rate, the EMI can change over time.

Still, the calculator is very useful for planning your budget. It gives a clear starting point and helps avoid surprises. Use it as a guide, but confirm details with your bank before final decisions.

Using a Land Loan Calculator to Compare Loan Offers Easily

When you want to get a loan, many banks offer different interest rates and terms. Using a land loan calculator, you can quickly compare these offers. Just enter the loan amount, rate, and tenure for each bank.

The calculator will show the monthly EMI and total payment for every option. This helps you see which loan is cheaper or suits your budget better. You don’t have to visit each bank or ask for details.

By comparing, you save money and pick the best loan easily. This tool makes the whole loan choosing process simple and fast.

Must read Car Detailing Prices

Tips to Maximize the Use of Your Land Loan Calculator for Best Results

To get the best from a land loan calculator, always use the latest interest rates. Check the bank website or call the bank for updated numbers. This keeps your calculations accurate.

Try different loan tenures and amounts to see how they affect your EMI. This helps you find a comfortable monthly payment. Don’t forget to include any extra monthly expenses you have.

Also, use the calculator to plan your loan prepayments. Some calculators allow this feature and show how much interest you save by paying early. This helps you clear your loan faster and save money.

Conclusion

Using a land loan calculator is very helpful when you want to buy land. It shows you how much money you need to pay every month. This helps you plan your budget well and avoid surprises. The calculator is easy to use and saves your time and effort.

Remember to check the latest interest rates and enter correct information to get good results. A land loan calculator helps you compare loan offers and pick the best one. It is a smart tool for everyone who wants to borrow money for land.

FAQs

Q: What is a land loan calculator?

A: It is a tool that helps you calculate how much you will pay monthly for a land loan.

Q: Can I use it for any loan amount?

A: Yes, you can enter any loan amount to see the monthly payment.

Q: Does it show total interest I will pay?

A: Yes, most calculators show total interest and total payment too.

Q: Is the result always exact?

A: The result is an estimate, not exact. Actual payments may differ slightly.

Q: Do I need internet to use a land loan calculator?

A: Usually yes, most calculators are online tools that need internet access.

Q: Can I compare loans from different banks?

A: Yes, you can enter different rates to compare loan offers easily.

Q: Does the calculator include extra fees like processing charges?

A: No, it usually does not include extra fees. Check those separately with your bank.

Stay Tuned MoneyForMore

[…] Must Read Land Loan Calculator […]