Earn More, Stress Less — With MoneyForMore.

CPI Insurance: What It Is, Why It Matters, and How to Avoid Unexpected Costs

What Is CPI Insurance? A Clear, Human-Centric Introduction

Collateral Protection Insurance (CPI) — it sounds complex, but it’s just a safety net for lenders. CPI, sometimes called force-placed insurance, is a type of policy that lenders take out to protect a financed vehicle if the borrower fails to maintain the required auto insurance. It’s like a backup plan — but not the kind you want to rely on.

When you take out an auto loan, your lender expects you to carry comprehensive and collision insurance. If you let that coverage lapse — even for a short period — the lender can step in, buy a CPI policy on your behalf, and charge you for it.

Important lesson: CPI insurance shields the lender, not you. It doesn’t offer the same range of benefits as traditional auto insurance and is almost always more expensive.

Why Do Lenders Use CPI Insurance?

Let’s break it down. When a bank, credit union, or dealership finances a car, they’re making an investment — in you and in the vehicle. The investor will lose a lot of money if something happens to the car and there is no insurance.

CPI is the lender’s way of making sure their financial interest is protected. Think about it: if a borrower crashes a financed car with no insurance, the lender is left with a worthless, unpaid loan. CPI steps in to cover that risk.

Lenders require:

- Comprehensive coverage – to protect against theft, fire, flood, etc.

- Collision coverage – to cover damage from accidents

If your insurance lapses or if you fail to provide proof, CPI kicks in automatically.

It’s not personal — it’s business. But it can feel very personal when your monthly payment suddenly jumps and you’re being charged for insurance you didn’t choose.

How Does CPI Insurance Actually Work?

Let’s say life gets hectic. You miss a renewal notice. Your insurance lapses for a few days. Suddenly, CPI is added to your loan.

Here’s how it typically plays out:

- Your lender notices a gap in coverage.

- They send you a warning letter or email (sometimes multiple).

- If no proof is received, they purchase CPI coverage.

- The premium is added to your loan balance.

- Your monthly payment increases — sometimes significantly.

The biggest issue? Borrowers often don’t notice until they see the extra charge. And because CPI isn’t always billed separately, it can be hard to spot.

CPI isn’t optional once it’s placed. Even if you restore your own insurance, you’ll still owe for the time CPI was active — unless you act fast and submit proof retroactively.

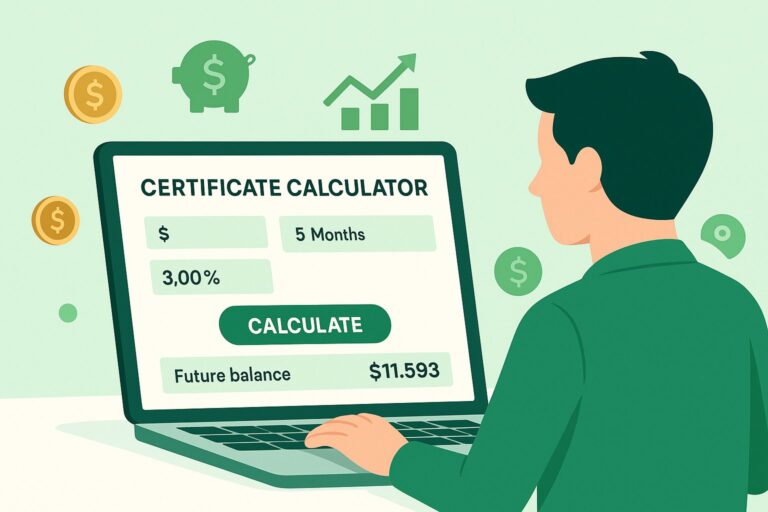

CPI Insurance Cost Estimator

CPI Insurance vs. Regular Auto Insurance: Know the Difference

Let’s compare apples to apples. CPI and regular auto insurance are not the same — not in coverage, not in cost, and not in control.

| Feature | CPI Insurance | Standard Auto Insurance |

| Who selects it? | Your lender | You |

| Who is covered? | Lender only | You, passengers, third parties |

| Coverage scope | Typically, just comprehensive & collision | Liability, medical, comprehensive, collision |

| Monthly cost | Higher (sometimes double or triple) | Lower (with options for discounts) |

| Claim payout | Goes to lender | Goes to you or relevant parties |

| Flexibility | None — you have no say | Full customization |

Bottom line: CPI protects the car as an asset — not your life, health, or finances.

Why CPI Insurance Costs More (and Covers Less)

Here’s the hard truth: CPI is expensive because it’s built for risk, not reward.

- No price shopping. Since you don’t pick the service, there isn’t any competition.

- No bundling discounts. You can’t combine CPI with home or life insurance for savings.

- Admin fees included. Lenders factor in handling and processing costs.

- High-risk profile. If your coverage lapsed, you’re considered a riskier borrower.

CPI premiums can be 2–3x higher than regular auto insurance. That means if you normally pay $100/month for insurance, CPI might cost you $250 or more — for less coverage.

But here’s the kicker: CPI won’t usually cover liability, medical payments, or uninsured motorists. So, if you’re in an accident and someone else is hurt? You’re on the hook — not the lender.

CPI Insurance Controversies: Consumer Complaints and Legal Fights

Over the last decade, CPI insurance has faced scrutiny — and for good reason. Some lenders and insurers were hit with lawsuits over:

- Charging borrowers for unnecessary CPI policies

- Placing coverage without proper notice

- Failing to cancel policies after proof of insurance was provided

- Pocketing commissions from CPI providers

In some class-action lawsuits, borrowers were awarded settlements for being wrongfully charged.

Not all lenders act in bad faith — but mistakes happen. That’s why it’s so important to keep an eye on your insurance and loan records.

Always open your mail. Always read the fine print. Always question unexpected charges.

How to Avoid CPI Insurance (And Keep Your Loan Healthy)

Avoiding CPI is 100% possible — and easy if you stay proactive.

Here’s your checklist:

- ✅ Maintain continuous insurance. Don’t let your coverage expire, not even for a single day.

- ✅ Set calendar reminders for policy renewals.

- ✅ Use autopay to prevent accidental cancellations.

- ✅ Send proof of insurance to your lender when requested.

- ✅ Confirm your lender’s address/email for sending updates.

- ✅ Save confirmation receipts for any insurance docs you submit.

And if you change insurance providers? Let your lender know before the new policy starts. That way, there’s no coverage gap to trigger CPI.

Being attentive is more important than being flawless.

Already Charged for CPI? Here’s What to Do

If CPI has already been added to your account, don’t panic. You can often get it removed — or at least partially refunded — with the right steps.

- Get your policy documents. Proof of coverage for the CPI period will be required.

- Contact your lender. Ask for the insurance or CPI servicing department.

- Submit your documents. Include your declarations page, dates of coverage, and insurer contact info.

- Request a refund. Politely but firmly ask for removal of CPI and reimbursement for overlapping coverage.

- Follow up. If you don’t hear back within 7–10 days, escalate the issue.

- Track your credit. Make sure CPI-related charges don’t lead to loan delinquencies.

If your lender refuses to cooperate, you can file a complaint with the Consumer Financial Protection Bureau (CFPB) or your state’s insurance commissioner.

Must Read : How Long Does a Speeding Ticket Stay on Your Record

Final Thoughts: CPI Insurance Is a Safety Net — But It’s Not Yours

CPI insurance exists for a reason — and in some cases, it serves a valid purpose. But it’s not your ally. It’s not tailored for your protection, your wallet, or your peace of mind.

It’s a silent contract between lender and insurer — and you’re footing the bill.

But here’s the good news: once you understand how CPI works, you can avoid it entirely. Stay insured. Communicate with your lender. Watch your loan statements like a hawk. And if CPI ever sneaks in? Handle it with confidence.

You’re not just a borrower — you’re a human being with responsibilities, yes, but also rights. Stay informed. Stay covered. Stay in control.

Conclusion

CPI insurance may sound like a safety net, but it’s really there to protect lenders — not you. It’s costly, limited in coverage, and often kicks in when you’re least expecting it. If you’re not careful, it can quietly inflate your loan balance and drain your wallet without providing the protection you truly need.

The fix? Stay insured, stay alert, and stay in touch with your lender. Make sure your auto policy never lapses, keep proof of coverage handy, and check your loan statements regularly. CPI is avoidable — and now that you know how it works, you’re already ahead of the game.

Stay Tunned MoneyForMore

FAQs

1. What is CPI insurance and who does it protect?

CPI insurance, or Collateral Protection Insurance, is a lender-purchased policy that protects the vehicle — not you. It’s placed when your own insurance lapses and only benefits the lender.

2. Why did I get charged for CPI insurance without warning?

If your car insurance coverage expired or proof wasn’t submitted to your lender, CPI can be added automatically. Lenders often send notices first, but sometimes the process happens quietly.

3. How is CPI insurance different from regular auto insurance?

Regular insurance covers you, your passengers, and others. CPI only protects the lender’s asset (the car) and usually doesn’t include liability, medical, or uninsured motorist coverage.

4. Can I remove CPI insurance charges from my loan?

Yes. If you show proof that you had valid insurance during the CPI period, you can often request removal or a refund. Act fast and contact your lender’s CPI department directly.

5. How much more does CPI insurance cost?

CPI insurance can be 2–3 times more expensive than standard auto insurance. That means if your regular coverage was $100/month, CPI might cost $250+ for far less protection.

6. Is CPI insurance legal?

Yes, but it’s heavily regulated. Lenders are allowed to protect their financial interest. However, improper placement or lack of notice has led to lawsuits and settlements in the past.

7. How can I avoid being charged for CPI insurance?

Maintain continuous coverage, use autopay for premiums, and send updated insurance documents to your lender. If you switch providers, notify your lender before the old policy ends.

8. What happens if I ignore CPI insurance charges?

Ignoring CPI charges can increase your monthly payment, lead to loan delinquency, and even hurt your credit score. Always check loan statements and dispute unexpected charges early.

9. Does CPI insurance offer any protection for me personally?

No. CPI insurance is designed to protect the car — not your health, liability, or legal expenses. You’ll be on the hook for any damages or injuries if you’re uninsured.

10. Is there a tool to estimate how much CPI insurance will cost me?

Yes! Use the CPI Insurance Cost Estimator in this article to find out how much you might be paying in extra charges. It’s quick, easy, and totally free.