Earn More, Stress Less — With MoneyForMore.

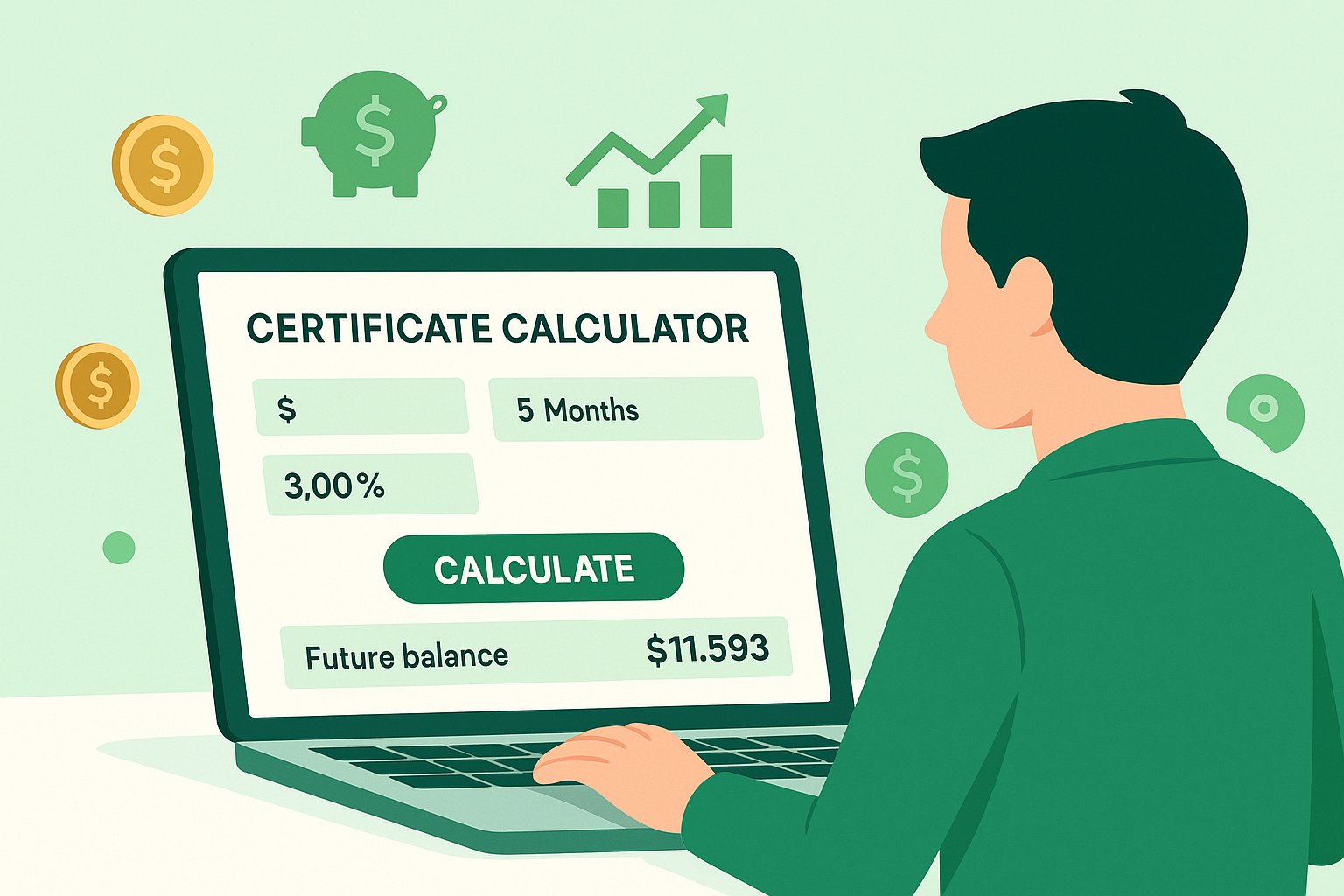

Understanding how much your savings will grow can be confusing, especially with all the financial terms out there. That’s where a certificate calculator becomes super helpful. It lets you figure out how much money you’ll earn over time by entering just a few simple numbers. Whether you’re saving for something big or just want to grow your money safely, this tool makes it easy to see your future balance clearly and quickly.

A certificate calculator is perfect for anyone who wants to avoid guessing and start planning smarter. It works by calculating interest on your deposit over a set time, showing how your money grows. You don’t need to be a finance expert — just enter your deposit, interest rate, and term, and you’ll see how much you can earn. This guide will walk you through everything you need to know about using this tool the right way.

What Is a Certificate Calculator and How Does It Work?

A certificate calculator helps you figure out how much money you will have at the end of your savings period. You just need to enter a few numbers like your starting amount, the interest rate, and how long you will keep the money saved. This calculator does the math for you, so you can plan better.

It works by adding interest to your savings over time. For example, if you put money in a certificate for one year, the calculator shows how much extra you will earn by the end. It’s simple, fast, and perfect if you want to grow your money with less risk.

This tool is great for beginners who don’t want to use complex formulas. You can see your total balance without any confusion. It also helps you compare different savings plans quickly and easily.

Even if you are new to saving, this calculator will guide you step by step. You just need to type in your details and check your final balance without any hard work.

How to Use a Certificate Calculator Step by Step

Start by entering the amount you want to save. This is your initial deposit, the money you put in at the beginning. Next, choose how long you will keep it there — it can be months or years, depending on your goal.

Then, enter the interest rate. This is the percent the bank will pay you for keeping your money with them. You also need to select how often the interest is added, like daily, monthly, or yearly. This is called compounding.

Once everything is entered, hit the calculate button. You will see your future balance and how much interest you’ll earn. This makes it easy to decide if the certificate is a good deal for you or not.

Always double-check the numbers before making a decision. Using the certificate calculator helps you avoid mistakes and gives you peace of mind when saving.

Try the calculator below to see your own savings growth in just a few clicks.

Certificate Calculator

Key Benefits of Using a Certificate Calculator

It saves your time by giving fast results. You don’t have to do long math problems to know your future balance. Just enter your savings plan, and you get the answer in seconds.

The calculator shows how much you earn clearly. It splits the total into your savings and your interest. This helps you understand exactly what you are getting from your certificate.

Another big benefit is that you can compare different offers. Try different deposit amounts and terms to see what works best. This way, you make smart choices without pressure.

Using the calculator also builds confidence. You know your numbers and can plan better for the future. It helps you feel in control of your money.

Certificate Savings Growth by Term & Rate

| Initial Deposit | APY (Annual % Yield) | Term Length | Compounding | Interest Earned | Total Balance |

|---|---|---|---|---|---|

| \$1,000 | 2.50% | 1 Year | Monthly | \$25.18 | \$1,025.18 |

| \$5,000 | 3.00% | 2 Years | Quarterly | \$305.45 | \$5,305.45 |

| \$10,000 | 4.00% | 3 Years | Annually | \$1,248.64 | \$11,248.64 |

| \$7,500 | 3.25% | 18 Months | Monthly | \$376.32 | \$7,876.32 |

| \$15,000 | 4.10% | 5 Years | Daily | \$3,370.27 | \$18,370.27 |

Compare Certificate Calculator vs. Manual Math

Manual math is slow and easy to mess up. You need to know formulas, rates, and how compounding works. Most people make mistakes when they try this by hand.

A certificate calculator is much easier. It uses correct formulas and gives quick answers. You don’t need to be good at math to use it well.

Also, the calculator updates fast if you change any number. Manual math would take a lot of time to recalculate everything.

In short, the calculator is smarter and faster. It helps you avoid errors and saves your effort, making saving simple for everyone.

Common Mistakes to Avoid in a Certificate Calculator

One mistake is putting the wrong interest rate. Always use the correct rate given by the bank. Sometimes people mix up APY with the regular rate.

Another error is entering months instead of years, or the other way around. Make sure to pick the right time format so the result is correct.

Also, don’t forget to check how often the interest is added. Compounding makes a big difference in your final amount.

Finally, double-check your numbers before you hit calculate. Taking a few extra seconds can help you avoid wrong results and bad choices.

Certificate Calculator Tips to Maximize Earnings

Try to go for certificates with higher interest rates. This gives you more earnings on the same deposit.

Pick longer terms if you won’t need the money soon. Longer terms often give higher rates, which means more profit in the end.

Compare different banks using the calculator. Some banks offer better deals than others, so checking a few options is smart.

Avoid early withdrawals. If you take out money before time, you might lose interest or pay a fee. Always plan your term properly.

Certificate Calculator for Short-Term vs. Long-Term CDs

Short-term CDs are good if you need money soon. They usually last for a few months and let you access your cash faster.

Long-term CDs grow more money because they earn more interest. But you need to keep your money locked in for years.

Use the calculator to compare both options. Enter the same deposit with different terms and see which one gives more value.

Choose short-term if you want flexibility. Choose long-term if your goal is higher earnings and you can wait.

When Should You Trust a Certificate Calculator

Trust it when using up-to-date numbers. Make sure the rates and terms you enter are correct and current.

These calculators are made with tested formulas, so they give accurate results when you use them right.

Always cross-check the calculator’s results with the bank’s offer. They should match closely unless extra fees or conditions apply.

Use it as a planning tool. While it’s not a bank guarantee, it gives you a strong idea of what to expect and helps you plan wisely.

Must Read Can You Trade In a Financed Car

Best Places to Find a Reliable Certificate Calculato

Bank websites often have trusted calculators. They are made to match the rates they offer and give true results.

You can also use calculators from credit unions or personal finance websites. Many of these tools are free and easy to use.

Look for calculators that update with the latest interest rates. This ensures your results are as close to real as possible.

Read reviews if you are unsure. A reliable calculator is simple, accurate, and gives quick answers without confusing steps.

Conclusion

Using a certificate calculator is a smart and easy way to plan your savings. It shows you how much money you will have in the future, just by entering a few numbers. You don’t need to be a money expert — the calculator does all the hard work for you. It helps you make better choices without any guesswork.

Whether you’re saving for something small or big, this tool makes saving simple and stress-free. You can try different amounts and time periods to see what works best for you. It’s like having a little helper for your money plans — and it’s totally free to use!

FAQs

Q: What is a certificate calculator?

A: A certificate calculator is a tool that helps you see how much money you’ll earn on a savings certificate.

Q: Is a certificate calculator free to use?

A: Yes! Most certificate calculators are 100% free and easy to use online.

Q: What info do I need to use it?

A: Just enter your deposit amount, interest rate, term length, and compounding type.

Q: Can it help me compare different CDs?

A: Yes, you can try different terms and rates to see which CD gives the best return.

Q: Does the calculator include taxes?

A: Some do. If not, you may need to subtract tax from the interest shown.

Q: Can I trust the result from the calculator?

A: Yes, if you enter the correct numbers, the results are very accurate.

Q: Where can I find a good certificate calculator?

A: Many bank websites and financial blogs offer free and reliable calculators.

Stay Tuned MoneyForMore