Earn More, Stress Less — With MoneyForMore.

If you’re wondering can you trade in a financed car, the short answer is yes—you can. Even if you still owe money on your current car, most dealerships can help you trade it in. But before you move ahead, it’s important to understand how the process works. You’ll need to know how much your car is worth, how much you still owe, and whether you have something called positive or negative equity. These things can affect your next loan or payment.

Many people think trading in a car with a loan is hard, but it’s not if you follow the right steps. In this guide, we’ll answer your big question: can you trade in a financed car and explain it in a way that’s easy to follow. We’ll also help you avoid common mistakes and give you better options if you’re stuck with a loan. This way, you can feel confident before walking into any dealership.

Can You Trade In a Financed Car With a Loan Left?

Yes, you can. Even if your car is not fully paid off, trading it in is possible. The dealer usually pays your remaining loan to the lender. But the value of your car matters a lot. If your car is worth more than the loan, it’s a good deal.

First, check your loan balance. You can find this in your online account or loan statement. Then, find out how much your car is worth. Use websites like Kelley Blue Book or Edmunds for this. Compare both numbers to know if you have extra value or if you still owe more.

This extra value is called positive equity. If you have it, you can use it as a down payment for your next car. It makes your next loan smaller and your payments easier. If you owe more than the car’s worth, it is called negative equity, and it needs a different plan.

Talking to your lender and getting the payoff amount is smart. Knowing the exact number helps you stay in control. It also makes sure you don’t get any surprise bills later.

How Can You Trade In a Financed Car Easily?

Start by checking your credit score. This helps you get a better deal on your next loan. A higher credit score can mean lower interest and smaller monthly payments.

Next, clean your car and fix small problems. A clean car gets better trade-in offers. Dealers like cars that look well-kept and don’t need extra repairs.

Then visit different dealerships to get quotes. Don’t say yes to the first offer. Compare offers to find the best price. Even a small difference in price can save you money.

Finally, make sure all your paperwork is ready. Bring your loan payoff letter, registration, and insurance. Being prepared makes the process faster and smoother.

Can You Trade In a Financed Car With Negative Equity?

Yes, but it needs more planning. Negative equity means your loan is more than your car’s value. It’s also called being upside-down on your loan.

In this case, you have two main choices. One is to pay the difference in cash. This is the best way to avoid adding more debt. It helps you start fresh with your next loan.

The second option is rolling the negative balance into your new loan. This adds the amount you still owe to the cost of the new car. But be careful—this makes your new loan bigger and can raise your monthly payment.

Before deciding, check your budget. If paying extra monthly is hard, try to wait. Keep your current car until you pay it down more. This helps reduce or remove the negative equity.

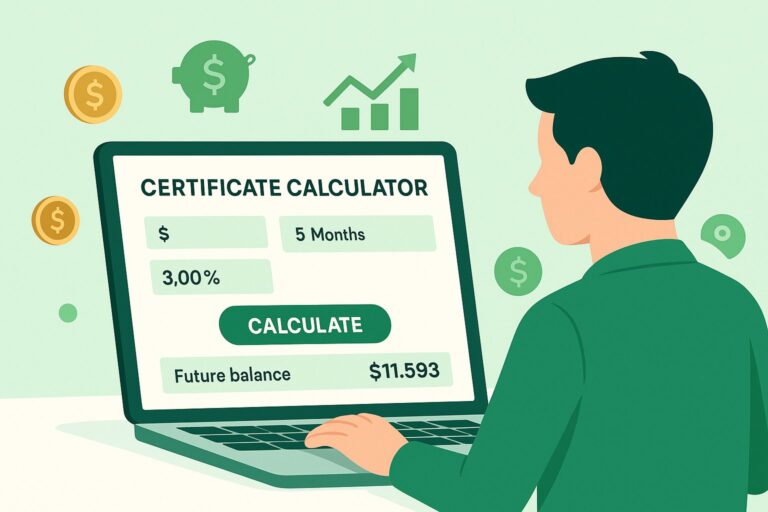

Trade-In Equity Calculator

Steps to Follow If You Can You Trade In a Financed Car

Step 1: Know Yourht Numbers

Find out can you trade in a financed car-in value. Use trusted sites like J.D. Power or Kelley Blue Book. Then check how much you owe on your loan.

Step 2: Clean and Repair Your Car

Dealers give more money for cars that are clean and well-maintained. Wash your car, fix minor damage, and get an oil change if needed.

Step 3: Visit Multiple Dealers

Get trade-in quotes from a few dealerships. Don’t go with the first offer. Compare and choose the one that helps you most.

Step 4: Review All Offers and Paperwork

When you pick a dealer, read every paper before signing. Make sure the dealer agrees to pay off your loan in full and you are not left with extra bills.

Can You Trade In a Financed Car to Lower Payments?

If your current loan has high payments, can you trade in a financed car can help. A cheaper car with a smaller loan can mean smaller monthly bills.

This works best if you have positive equity. Can you trade in a financed car your car is worth more than your loan. That extra amount reduces the cost of your next car.

But even with negative equity, you might still save. If the new car has a better interest rate or a lower price, your payments can go down. Just be sure the numbers work for you.

Always use a car loan calculator. It shows your possible payments before you agree to the trade.

| Scenario | Before Trade-In | After Trade-In |

|---|---|---|

| Car Loan Balance | \$13,000 | \$0 (Dealer paid off old loan) |

| Car Value (Trade-In Offer) | \$11,000 | \$11,000 used as part payment |

| Equity Status | Negative Equity (-\$2,000) | Rolled into new loan |

| New Car Price | — | \$18,000 |

| Down Payment (from Equity) | — | \$0 (rolled over debt) |

| New Loan Total | — | \$20,000 (includes \$2,000 negative equity) |

| Monthly Payment (estimated) | \$450/month | \$370/month (longer term, lower rate) |

| Interest Rate | 9.5% | 6.0% (with good credit) |

| Loan Term | 48 months | 60 months |

What Happens When You Can You Trade In a Financed Car?

The dealer will check your car and give you can you trade in a financed car-in offer. Then they pay off your loan with the lender. If there is money left, they use it for your next car.

If you owe more, they might let you roll that amount into the new loan. But that makes your debt higher. It’s better to pay off the extra if you can.

You will sign a new contract for your next car. Check the details. Make sure the dealer paid off your old loan and you are not still responsible.

A few weeks later, confirm with your lender that the loan is closed. Ask for a letter that shows the loan was fully paid.

Can You Trade In a Financed Car for a Lease Vehicle?

Yes, you can. Trading in your car for a lease is common. The process is almost the same as trading for a new car.

If you have positive equity, it lowers your lease payments. This is great if you want lower monthly bills and don’t drive too much.

If you have negative equity, it gets added to the lease contract. But be careful—leases already have limits and fees. Adding more debt may not be smart.

Can you trade in a financed car? Talk to the leasing company or dealership. They can help you see if this choice is good for your budget and lifestyle.

Must Read Is a Citation a Ticket

Best Time to Decide If Can You Trade In a Financed Car

The best time is when your car has positive equity. This means the car’s value is more than your loan. You get a better deal and pay less on your next car.

Another good time is when interest rates are low. A low rate on your next loan saves you money every month.

Can you trade in a financed car? Try not to trade during high inflation or when car prices are very high. Wait until the market is stable so you get the best value.

Also, check if your current car needs big repairs. It might be better to trade in before those costs come up.

Estimate Your Trade-In Loan: Can You Trade In a Financed Car?

💰 Trade-In Loan Estimator

Conclusion

Trading in a financed car may sound tricky, but it’s not that hard if you know what to do. Always check how much your car is worth and how much money you still owe. If your car has positive equity, it’s a good time to trade it in. That extra value can help you save money on your next car.

If you have negative equity, don’t worry. You still have options. You can pay the difference, roll it into the next loan, or wait a bit until your loan is smaller. Just be smart, take your time, and always read everything before signing any papers. This way, you won’t get stuck with extra costs later.

FAQs

Q: Can I trade in my car if I still owe money on it?

A: Yes, you can. The dealer usually pays your loan, but check if you have extra or less value.

Q: What is positive equity in a car?

A: It means your car is worth more than the loan you still need to pay.

Q: What is negative equity?

A: It’s when your loan is more than what your car is worth. That means you owe more than the car’s value.

Q: Can I roll over my loan into a new one?

A: Yes, but it adds more debt. Only do it if you really need to.

Q: Is it better to pay off the loan before trading in?

A: Yes, that’s the best option. But if not possible, check what works best for your budget.

Q: Do I need good credit to trade in my car?

A: Good credit helps you get a better deal, but you can still trade in with fair credit.

Q: Can I trade in a financed car for a lease?

A: Yes, you can. Just be sure the numbers work for your wallet and driving needs.

Stay Tuned MoneyForMore