Earn More, Stress Less — With MoneyForMore.

When you want to keep your important things safe—like jewelry, family papers, or old coins—a safe deposit box can help. But before getting one, you should understand the safe deposit cost. This means how much you’ll pay each year to rent the box and what other charges may come with it, like late fees or key replacements. Knowing the price helps you choose the best and most affordable option for your needs.

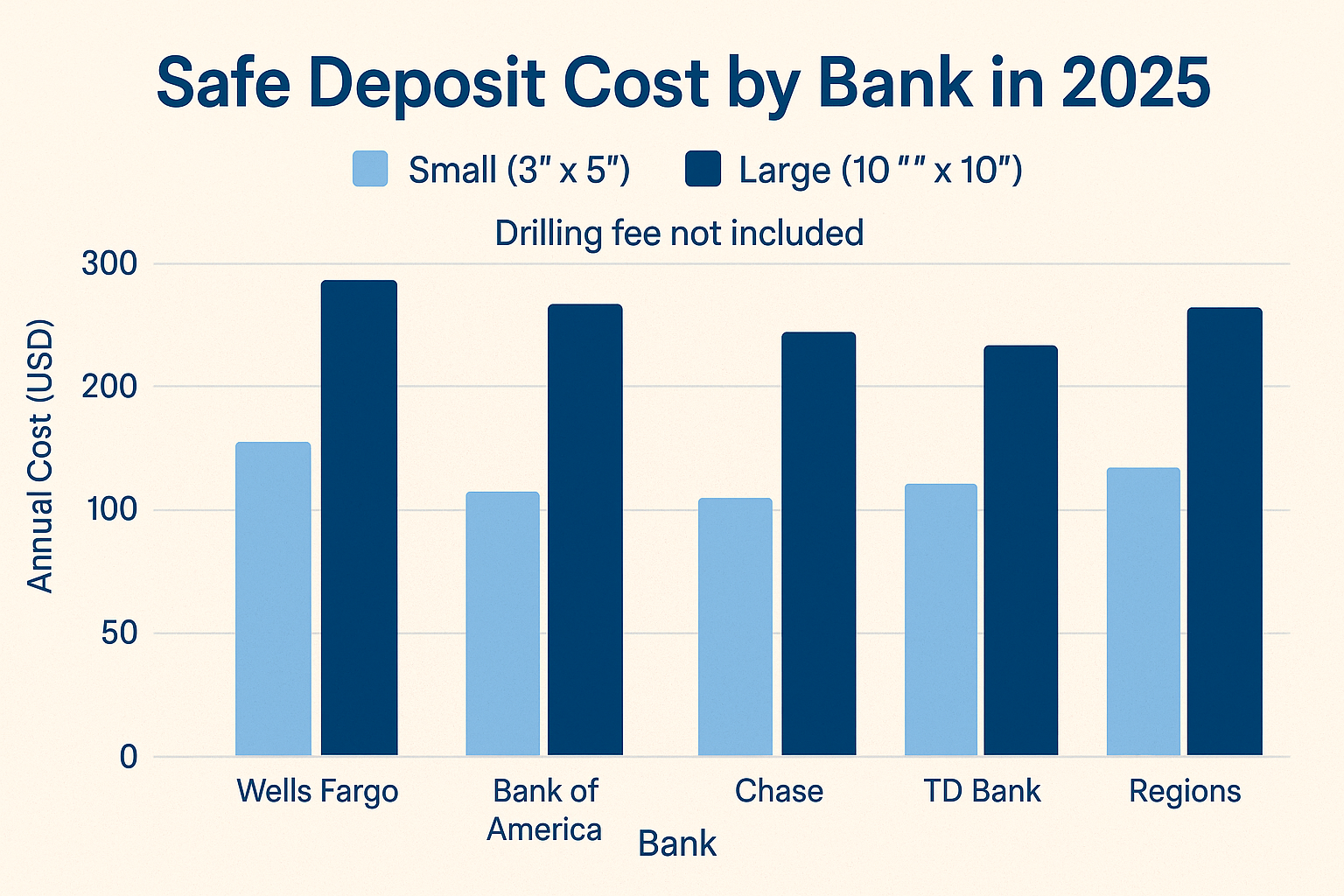

The safe deposit cost depends on many things like the bank, the size of the box, and even where the bank is located. Some banks offer small boxes for as low as $40 per year, while bigger boxes can go over $300. Also, some banks give discounts if you have a certain account type with them. In this article, we’ll make everything easy to understand so you can decide if a safe deposit box is right for you—and how to get the best deal without any surprises.

What Is the Average Safe Deposit Cost in 2025?

The average cost to rent a safe deposit box in 2025 starts around $40 to $60 per year for small sizes. These are great if you just want to store a few papers or small jewelry. But if you want a bigger box, like one for family records or collections, the cost can be $100 to $300.

Every bank sets its own price. Some may charge a little more in big cities where space costs more. You can call your local branch to get the exact amount. This helps you plan your yearly budget.

The size and location are two main things that change the safe deposit cost. Banks in rural areas usually charge less than banks in busy city areas. So if you’re okay with traveling a bit, you could save money.

Many banks also offer digital vaults now. These let you keep your documents online. They might cost less, but you need internet and know-how to use them.

Safe Deposit Cost by Box Size: Small to Extra Large

Small boxes are usually 3×5 inches and cost about $40 to $80 yearly. These are good for birth certificates or rings. They’re cheap and simple.

Medium boxes, like 5×10 inches, can cost $100 to $150 a year. These fit more, like property papers or small keepsakes. If you need extra space, this size is a good middle option.

Large boxes, like 10×10 inches or more, can cost $200 or more each year. They’re perfect for big items like collections or legal files. But remember, the bigger the box, the higher the safe deposit cost.

Before picking a size, think about what you want to store. It’s better to choose a box that fits everything instead of paying for extra space you don’t need.

How Safe Deposit Cost Varies by Bank Location

Different banks charge different fees based on where they are. A small-town branch might charge less than a big-city one. That’s because city rent is higher, and banks pass that cost to you.

In places like New York or Los Angeles, even a small box can cost $80 to $100 a year. But in a smaller town, you might get the same box for $40 to $50. So your address matters more than you think.

Also, some banks in expensive neighborhoods may only offer larger boxes. That means you may have to pay more even if you don’t need much space. Always ask your bank what sizes they have before deciding.

Compare prices from at least two to three banks near you. That way, you get the best safe deposit cost without overpaying.

| Bank Name | Small Box (3×5 in) | Medium Box (5×5 in) | Large Box (10×10 in) | Drilling Fee | Key Replacement Fee |

|---|---|---|---|---|---|

| Bank of America | \$75/year | Not Listed | \$300/year | \$150 | \$10–\$25 |

| Chase | \$55/year | Not Listed | \$300/year | \$150 | Key deposit required |

| Wells Fargo | \$80/year | Not Listed | Not Listed | \$125–\$175 | \$20 for 2 keys |

| TD Bank | \$60/year | Not Listed | \$5/sq in (custom sizes) | \$200 | \$50 |

| PNC Bank | Varies by location | Varies by location | Varies by location | Varies | \$15 for 2 keys |

| RBC (Canada) | \$60/year | \$110/year | \$350–\$500/year | Not Listed | Not Listed |

| Scotiabank (Canada) | \$60/year | \$150/year | \$400/year | Not Listed | Not Listed |

Extra Fees That Affect Your Total Safe Deposit Cost

Besides the yearly rental fee, banks may charge for other things. One common fee is if you lose your key. Replacing it might cost $20 to $50. If they have to drill open your box, it could cost over $150.

Some banks also charge a late fee if you don’t pay on time. This can be around $10 to $25. It’s a small amount, but if you forget, it adds up over time.

If you need extra keys for a co-renter, there could be a small fee too. And some banks charge a one-time setup fee when you first rent the box.

Knowing these hidden costs helps you understand the full safe deposit cost. Always ask for a fee list before signing the rental form.

Safe Deposit Cost vs. Digital Vault Options

Digital vaults are now a new option. They let you keep your important papers safe online. You can access them anytime with a password.

The cost for digital vaults may be monthly or yearly. Some start free but charge more for extra space or features. Unlike a bank box, you don’t need to go anywhere to access it.

However, digital vaults may not be great for physical items like rings or photos. For that, a bank box is better. It depends on what you need to keep safe.

In many cases, combining both is smart. Use a digital vault for documents and a deposit box for jewelry. That way, you control your safe deposit cost and get the best of both worlds.

Ways to Lower Your Annual Safe Deposit Cost

Many banks give discounts if you have a premium account. For example, some banks give 50% off to customers with savings or VIP plans. Always ask if you qualify.

Choosing a smaller box can also save money. Don’t pay for space you won’t use. Measure your items first to find the right fit.

Paying yearly instead of monthly can also bring small savings. Some banks offer a discount for full-year payments.

Lastly, compare different banks before renting. Some may offer promotions or waive fees for new customers. It can help reduce your safe deposit cost.

Safe Deposit Cost for Joint Access and Co-Renters

You can add a co-renter to your box if you trust someone like a family member. They will get access just like you. Most banks do not charge extra for this, but some may charge for an extra key.

If you both want to visit the box, check if both must be present. Some banks require it, while others allow one person to come alone.

Having a co-renter is useful in case of emergencies. But make sure you trust them 100% with your valuables.

Ask the bank to explain how co-renting works. This helps you avoid surprises that could raise your safe deposit cost later

Is the Safe Deposit Cost Worth It for Your Valuables?

If you have items that are very important or hard to replace, a safe deposit box is a smart choice. It keeps them safe from theft, fire, or flood.

The cost each year is usually small compared to the value of what you’re protecting. Paying $60 a year is worth it to keep something like a birth certificate safe.

But if you only have digital files, a digital vault might be cheaper and easier. It depends on what you want to keep safe.

Think about your needs, compare prices, and decide what works best. Only you can judge if the safe deposit cost is a good deal.

Must Read CPI Insurance

Safe Deposit Cost and Insurance: What’s Covered?

Most banks don’t insure what’s inside your safe deposit box. If there’s a fire, flood, or theft, the bank may not pay you back. That’s why insurance matters.

You can add a rider to your home insurance to cover items in the box. Some companies also offer special safe deposit insurance.

Always ask your bank what is covered and what is not. They might help you connect with an insurance company.

This way, even if you pay a small safe deposit cost, your valuables are still fully protected. It gives you peace of mind and extra safety.

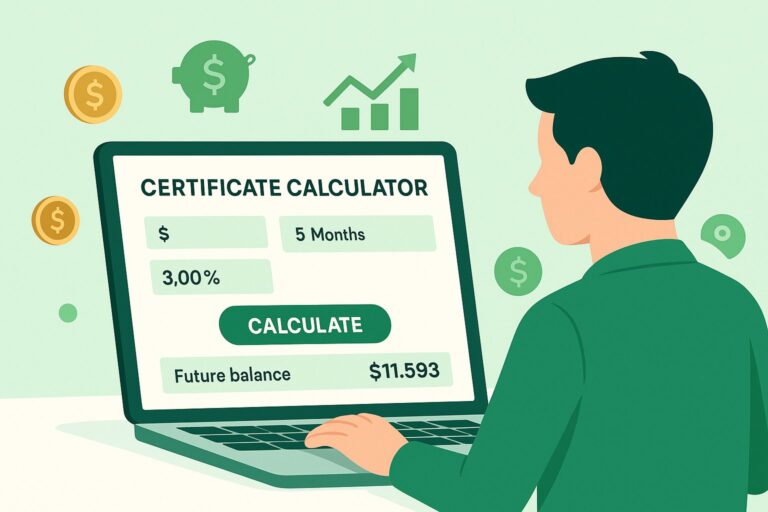

Safe Deposit Box Cost Calculator

Conclusion

In the end, a safe deposit box is a good idea if you want to keep your special things safe. It can protect your jewelry, family papers, or anything that is important to you. Even though you pay a small fee each year, it gives you peace of mind that your stuff is locked away safely.Before you rent a box, always check the size, price, and any extra fees. Ask your bank about discounts or deals. Also, think if you want to use a digital vault instead. Pick the option that works best for you and keeps your valuables safe without spending too much.

FAQs

Q: What is the average safe deposit cost in 2025?

A: Most small boxes cost between $40 to $80 per year, and big ones can go over $300.

Q: Can I store cash in my safe deposit box?

A: No, it’s not a good idea. Cash is not insured and should be kept in a bank account instead.

Q: Who can open my safe deposit box?

A: Only you and someone you add as a co-renter can open it. The bank staff can’t open it alone.

Q: What happens if I lose my key?

A: You’ll need to pay for a replacement key or a drilling fee, which can cost $50 to $150 or more.

Q: Are the items in my safe deposit box insured?

A: No, banks don’t insure them. You must get your own insurance if the items are very valuable.

Q: Can I get a discount on my safe deposit cost?

A: Yes, some banks give discounts if you have a premium or VIP account with them.

Q: What size box should I choose?

A: Pick a box that fits your items. Don’t pay for extra space you don’t need. Start small and upgrade later if needed.

Stay Tuned MoneyForMore