Earn More, Stress Less — With MoneyForMore.

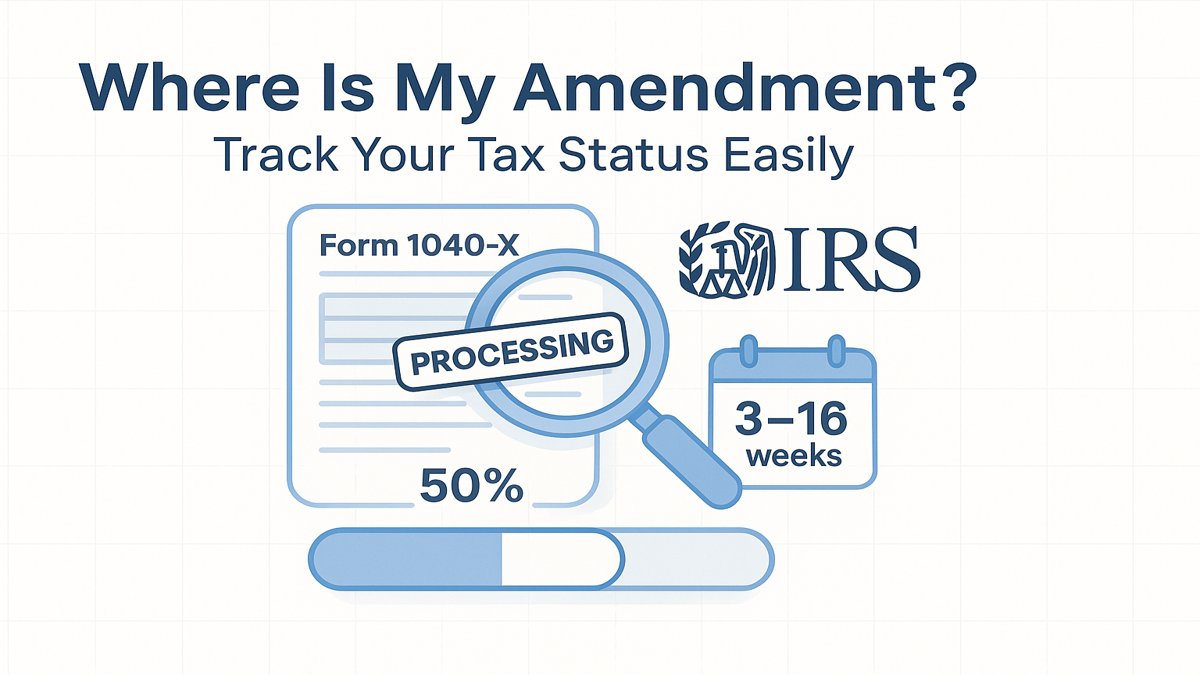

Did you file a tax amendment and now wonder, ‘Where is my amendment?’ You’re not alone! Many people ask, ‘Where is my amendment?’ because the IRS takes time to process it. Don’t worry—this guide will show you how to track it step by step, in super simple words!

Where Is My Amendment? – What It Means

When you ask, “Where is my amendment?” you’re checking the status of your corrected tax return (Form 1040-X). The IRS updates this in their system, but it doesn’t happen right away.

Fixing mistakes on taxes is common—maybe you forgot income or claimed the wrong deduction. The IRS lets you update it, but processing takes weeks.

You can track your amendment online or by phone. Just know it won’t show up instantly—wait at least 3 weeks before checking.

Why Do People File Amendments?

- Wrong income reported

-

Missed tax credits

-

Changed filing status

Where Is My Amendment Status? Check Online

The easiest way to track your amendment is using the IRS “Where’s My Amended Return?” tool. You’ll need your Social Security number, birth date, and ZIP code.

First, go to the IRS website and find the tool. Enter your details, and it’ll show if your amendment is received, processing, or completed.

If it says “received,” the IRS has it but hasn’t finished reviewing. “Adjusted” means they made changes, and “completed” means it’s done—check your mail for updates.

What If the Tool Doesn’t Work?

-

Wait 3 weeks after mailing

-

Try again later (system updates overnight)

-

Call IRS if still not showing

Where Is My Amendment Taking So Long?

The IRS says amendments take 8 to 16 weeks to process—sometimes longer if there’s a problem. Unlike regular refunds, these aren’t fast because they’re checked manually.

Delays happen if:

-

Your form has errors

-

The IRS is extra busy (like near tax deadlines)

-

They need more documents

If it’s past 16 weeks, call the IRS at 866-464-2050. But don’t panic—slow doesn’t mean denied!

Can You Speed It Up?

-

File electronically (faster than paper)

-

Double-check for mistakes before sending

-

Avoid mailing during peak times

Amended Return Status Calculator

IRS Amendment Tracker (2025)

const completionDate = new Date(filingDate); completionDate.setDate(completionDate.getDate() + 112); // 16 weeks

const callDate = new Date(completionDate); callDate.setDate(callDate.getDate() + 7); // 1 week buffer

// Display results document.getElementById('status-check-date').textContent = statusCheckDate.toLocaleDateString(); document.getElementById('completion-date').textContent = completionDate.toLocaleDateString(); document.getElementById('call-irs-date').textContent = callDate.toLocaleDateString();

document.getElementById('calculator-results').style.display = 'block'; document.getElementById('delay-alert').style.display = 'block';

// Smooth scroll to results

document.getElementById('calculator-results').scrollIntoView({ behavior: 'smooth' });

});

});

Where Is My Amendment Refund? Get Answers

If your amendment means a refund, you’ll get it by check or direct deposit. But don’t use the normal “Where’s My Refund?” tool—it won’t show amendment refunds.

Instead, check the amended return tracker. If it says “completed,” your refund should arrive in 2-3 weeks. If not, call the IRS.

What If the Refund Is Wrong?

-

Wait for the IRS explanation letter

-

Call them if the amount doesn’t match

-

Keep copies of your forms

Where Is My Amendment Form 1040-X? File Right

Form 1040-X is how you fix tax mistakes. You must fill it out correctly—Column A (original numbers), Column B (changes), and Column C (correct amounts).

Attach proof like W-2s or receipts. Mail it to the IRS address for your state (find it on their website).

Common Mistakes to Avoid

-

Forgetting to sign the form

-

Sending old tax returns without updates

-

Not explaining why you’re amending

Where Is My Amendment If I Made a Mistake?

If you filed the wrong amendment, the IRS will send it back or ask for fixes. Don’t resend unless they tell you to—wait for their letter first.

How to Fix Errors

-

If rejected, correct the mistake and refile

-

If accepted but wrong, file another amendment

-

Keep all IRS letters for proof

Where Is My Amendment Deadline? Don’t Miss It

You have 3 years from your original tax filing date to amend for a refund. After that, the IRS won’t accept changes.

What If You Owe Money?

-

File ASAP to avoid extra fees

-

Pay at least part of what you owe quickly

Must Read Land Loan Calculator

Where Is My Amendment Pro Tip? Speed It Up

-

File electronically (faster than mail)

-

Track your amendment after 3 weeks

-

Keep IRS notices for reference

Final Thoughts

Now you know where is my amendment and how to track it. Just be patient—the IRS moves slowly but will process your changes. Check the online tool, and if it’s too long, give them a call.

Conclusion

So there you have it! Now you know exactly how to answer the question “Where is my amendment?” Checking your tax amendment status is easy when you use the IRS online tool or call them. Just remember—amendments take time, so don’t worry if yours isn’t done right away. Stay patient, keep your info handy, and you’ll get your update soon!

Thanks for reading! If you found this guide helpful, share it with friends who might be wondering about their amendments too. And if you still have questions, check out the FAQs below. Happy tracking, and may your tax refund come quickly!

FAQs

Q: How long does it take for an amendment to show up?

A: It usually takes about 3 weeks to appear in the IRS system. After that, processing can take up to 16 weeks.

Q: Can I check my amendment status online?

A: Yes! Use the IRS “Where’s My Amended Return?” tool with your SSN, birthday, and ZIP code.

Q: What if my amendment isn’t showing online?

A: Some amendments (like business or foreign ones) don’t appear online. Call the IRS at 866-464-2050 instead.

Q: Will the IRS tell me if there’s a problem?

A: Yes! They’ll mail you a letter if something’s wrong. Always check your mailbox!

Q: Can I speed up my amendment?

A: Not really—amendments take time. But double-checking your form before sending helps avoid delays!

Q: When will I get my refund from an amendment?

A: After processing finishes (up to 16 weeks), the IRS will mail your refund. Track it in the tool!

Q: What if I made a mistake on my amendment?

A: If it’s small, the IRS may fix it. For big errors, they’ll contact you. Always keep copies of what you sent!

Stay Tuned MoneyForMore